Basic features of the GoPay account

In this text you can read about basic features of the GoPay account.

Basic info

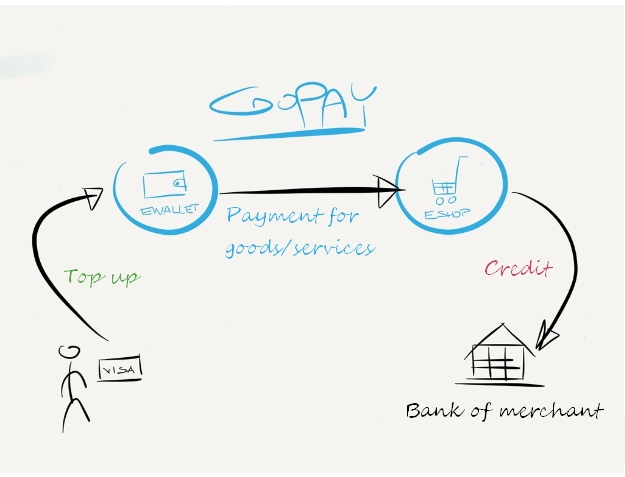

The GoPay account is a tool designed for making online payments. As the things around us become more online, so do our wallets and money. Imagine a GoPay account as a digital wallet which you can use every day. GoPay account is a digital wallet for digital money. In other words GoPay account holds funds which are issued by the GoPay Czech company, based on the due license for operating as a financial institution.

GoPay account is a basic and core product of the GoPay payment system. All of the other services we offer are dependent on the GoPay account of the client. In other words you always need to have a GoPay account so that we can offer you a payment gateway because your payments are credited to that account.

The main identifying element of the GoPay account is an e-mail address and GoID number which you can find in your GoPay account.

Digital money

The money hold in the GoPay account is digital as well as the digital wallet.

GoPay issues its own money as well as national banks do.

The only thing necessary for you to use a GoPay account is having enough funds in your account. It’s always up to you how much money you top up. There are many ways how to top up your account - from bank transfers to SMS payments. You can find more information about topping up in your GoPay account in the “Dobíjení” (Top up) section.

Levels of identification

GoPay account is a digital wallet for money. The account is subject to the anti-money laundering law and rules. That’s why we need to know the identity of the wallet owner when specific financial limits are reached. There are 4 identification levels:

- unverified

- partially verified

- verified

- fully verified

After you create a GoPay account the level of identification is automatically unverified. You can find more information about the identification levels here.

The identification level you choose defines the GoPay account settings, especially financial limits. You can find more information about limits here.

Financial limits

There are 3 basic financial limits for the GoPay account which defines the way how you can use top-uped money.

1. Maximum balance - a parameter which defines a maximum balance allowed for financial limits.

2. Maximum volume of accepted payments - it is a cummulative parameter per a calendar year (from January 1 to December 31). This parameter accounts for all the incoming payments.

3. Maximum volume of bank payments - it is a cummulative parameter per a calendar year (from January 1 to December 31). This parameter accounts for all the outcoming bank payments.

You can never exceed any of the parameters. In other words the counterparty which attempts to exceed some of the limits of the GoPay account will be denied to make a payment.

At the moment of reaching the volume limits you must wait untill another year begins or you need to level up your identification so that your limits would be higher.

Payments

Based on the identification level there are two options how you can make payments.

- e-mail payments

- payments to a bank account

1. E-mail payment

An e-mail payment is a payment when electronic money is sent to another GoPay account identified by an e-mail address. The GoPay payment system supports payments to those e-mail address which don’t have a GoPay account.

2. Payment to a bank account

You can make a payment either to a verified or unverified account, depending on the identification level.

Verified bank account is an account which is connected to your GoPay account and we’ve verified your access to this account with an identifying payment. You can have as many accounts like that as you want to. It always depends on the identification level.

Unlike other digital wallets with a GoPay account you can make payments to unverified bank accounts. That means that a GoPay account can be considered as a common bank account because the functionalities are the same at the basic level.

Unverified bank account is any bank account which is not connected to your GoPay account.

Payment to a bank account means that you send money out of the GoPay system.

Create a GoPay account and enjoy all the features. It’s free.